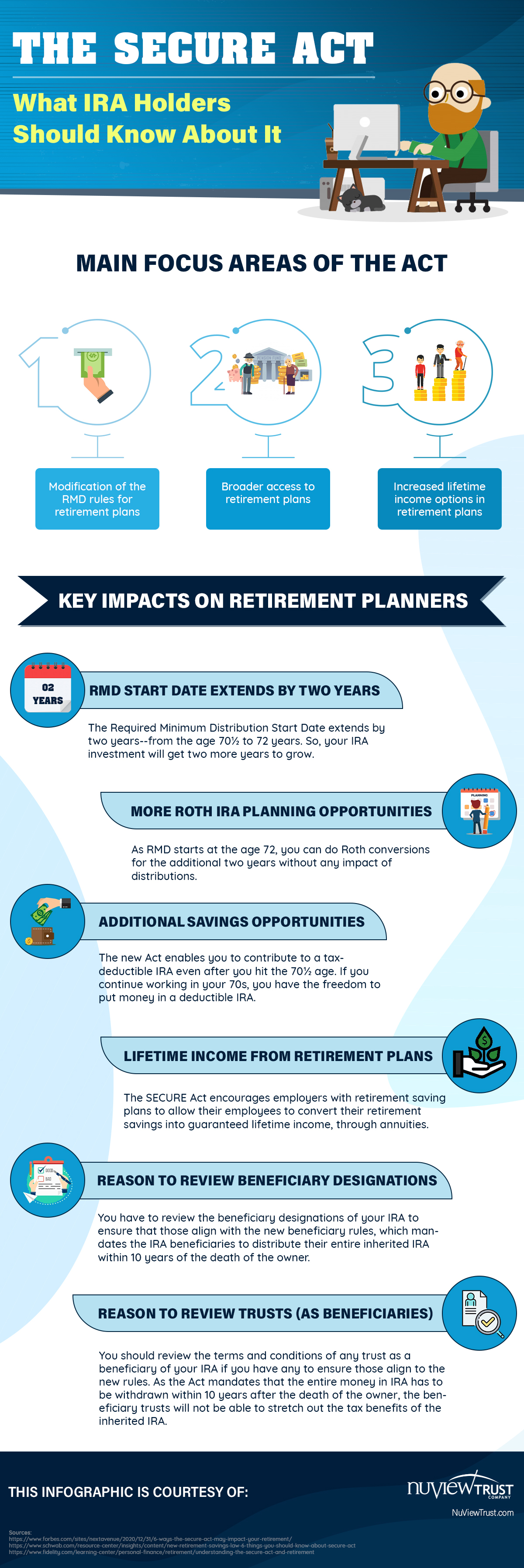

The Setting Every Community Up for Retirement Enhancement Act, also famous as SECURE Act, is here to help you save efficiently for your retirement. The Act aims at improving the retirement prospects of all the people here in the U.S. It comes with provisions for both individual savers and employers too.

The SECURE Act has made significant changes to IRAs and 401(k)s. It includes the power to postpone distributions and decreased flexibility for inherited IRAs. It also enables new parents to avail of penalty-free withdrawals. The following are three useful money moves you can make to optimize your IRA under SECURE Act.

1 – Make more Roth conversions

Earlier, you could make contributions to traditional IRA till the age of 70½. But, the new law has removed the age limit. It enables you to use the backdoor Roth IRA strategy. In simple words, you can avoid RMDs and, instead, resort to tax-free investment plans offered by Roth. It means you can apply for Roth IRA conversions even if you are past 70½.

2 – Reconsider IRAs for estate planning

If you want to leave a great sum of money to your heirs, then you need to reconsider the option of investing in IRAs. As per the new law, your non-spouse beneficiaries must empty the inherited money within ten years. It means your beneficiaries might need to pay hefty taxes. So, it’s best to consult an estate plan expert and explore the best options to invest as per the new law.

3 – Continue contributing to your IRA as long as possible

As mentioned before, the old law didn’t allow contributing to a traditional IRA once you turn 70½. Since the age limit got eliminated with the new law, now you can keep contributing to your IRA, even after turning 70½. The only condition is you should still be getting income for your work. It allows you to save as much as you can while not exceeding contribution limits.

To summarize

Those were the three money moves you can make to optimize your IRA under SECURE Act. By following the above suggestions, you can indeed foster your retirement savings and reap the maximum benefits.